Share This Post

What Seniors Must Know About Medicare Advantage Plans

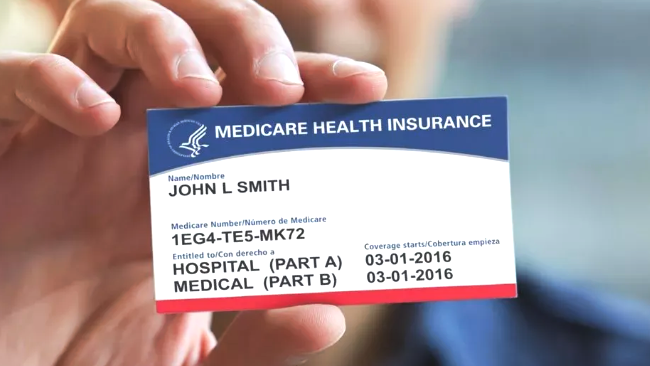

If you're eligible for Medicare, you can opt to receive your benefits through either Original Medicare (Part A and Part B) or the Medicare Advantage Plan, also called Part C. With a traditional Medicare plan, your covered health benefits are paid for directly by the government. With Medicare Advantage, you receive benefits from a private insurance company, who is then paid by the government. Here's what you need to know about each route to ensure you have the coverage to stay healthy.

Benefits of Medicare Advantage Plans

An approved Medicare Advantage insurer must provide coverage that is equal to or better than the coverage you would receive under traditional Medicare. If you enroll in Medicare Advantage, however, you will still receive hospice benefits under Part A. Many Medicare-eligible seniors opt for an Advantage plan because:

- These plans often provide benefits beyond what is covered by traditional Medicare, including but not limited to vision, hearing and dental care, gym memberships or wellness programs and prescription drug coverage. Those with Medicare Part A and B must instead enroll in a separate prescription drug plan (Part D).

- Although costs vary by plan, Part C typically has a lower out-of-pocket cost than other Medicare plans because the provider network of doctors is able to coordinate care and offer decreased fees for subscribers.

- Most Part C plans carry a cap on your out-of-pocket costs. Once you reach this threshold, your health care costs should be completely covered for the rest of the year, provided you stay in network.

- Medicare Advantage Special Needs Plans are available for those who have both Medicare and Medicaid coverage, need skilled nursing care and/or have a chronic condition that needs ongoing care.

Drawbacks of Medicare Advantage

For some individuals, traditional Medicare may be the better option. You may want to stick with Medicare Parts A and B if:

- You are concerned about out-of-pocket costs, which can increase each year with Medicare Advantage and vary significantly depending on your insurer.

- You don't want to switch insurance plans again. An insurance company can offer an Advantage plan one year and discontinue it the next, which means your coverage search would begin anew.

- You want to avoid getting referrals for specialty care or being restricted to doctors within the plan network.

- Insurers do not offer Medicare Advantage plans in your area.

- You take several prescriptions and need dedicated prescription drug coverage. It's important to compare the costs of your medications under the Advantage plan you're considering to those charged by Part D.

- You prefer to have a higher monthly premium in exchange for lower copayments and coinsurance costs. Keep in mind that although some Medicare Advantage plans do not have a monthly premium, you will still need to pay your monthly Part B premium.

Sackett & Associates Insurance Services is your trusted Medicare insurance broker in Sonoma County and surrounding areas. Call us at 707-823-3689 to speak to an experienced representative who can help you shop around for the best health care coverage for your needs. To learn more about Medicare and related topics, please like us on Facebook, find us on LinkedIn and subscribe to our blog.

Share This Post

Taking The Pain Out Of Health Insurance

We make it simple to find the right insurance plans for your needs

In just a few quick steps.