Share This Post

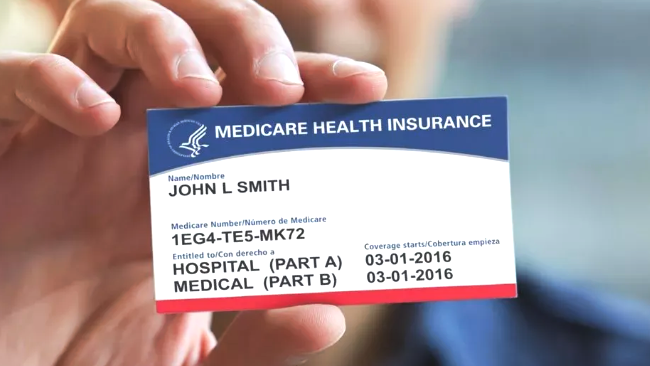

Missed Medicare Enrollment? Here’s What You Can Do Next

If you missed the Medicare open enrollment or Annual Election Period (AEP), don’t panic. While the window from October 15 through December 7 is the main opportunity to adjust your coverage for the next year, there are still ways to make changes.

What AEP Covers

During the Annual Election Period, Medicare beneficiaries can:

- Switch from Original Medicare (Parts A and B) to a Medicare Advantage (Part C) plan.

- Move from a Medicare Advantage plan back to Original Medicare.

- Change or join a Part D prescription drug plan.

- Switch from one Medicare Advantage or Part D plan to another.

If no action is taken by December 7, your coverage automatically renews for the next year. That means you’ll stay in the same plan you had, including the same premiums, deductibles, and provider networks, even if those costs or networks change.

If you realize after December 7 that your plan isn’t a good fit, the good news is that Medicare gives you another chance early in the year, but only if you’re enrolled in Medicare Advantage.

Medicare Advantage Open Enrollment

From January 1 through March 31, the Medicare Advantage Open Enrollment Period allows individuals already enrolled in a Medicare Advantage (MA) plan to make certain changes, such as:

- Switch to another Medicare Advantage plan that better matches your healthcare needs, preferred doctors, or prescription coverage.

- Drop your MA plan and return to Original Medicare. If you make this change, you can also join a stand-alone Part D prescription drug plan.

You can make only one change during this period. Once you select a new Medicare plan, the new coverage will start the first day of the month after your request is received. For example, if you switch to a new plan on February 10, your new coverage begins March 1.

When Special Enrollment Periods (SEPs) Apply

A Special Enrollment Period (SEP) allows you to make changes to your Medicare coverage outside the regular enrollment windows. These are some common situations that trigger an SEP.

1. You Move to a New Location

If you relocate outside your plan’s service area, or even within the same area but where new plan options exist, you can change to a new Medicare Advantage or Part D plan.

You typically have two months from the date you move to make a new selection.

2. You Lose Other Health Coverage

Losing employer or union coverage, Medicaid eligibility, or other “creditable” coverage gives you an SEP to find a new Medicare plan.

The timing depends on when your other coverage ends, but it usually lasts for two months after the loss.

3. Your Plan Changes Its Contract With Medicare

If your current Medicare Advantage or Part D plan leaves Medicare or stops operating in your area, you’ll have an SEP to switch to a new plan.

This period usually begins two months before your coverage ends and continues one month after it ends.

4. You Qualify for Another Type of Coverage

Joining a program such as TRICARE, the Veterans Health Administration (VA), or a PACE plan (Program of All-Inclusive Care for the Elderly) opens a special window to make changes.

5. Exceptional Circumstances

Events beyond your control, like being affected by a natural disaster, serious illness, incarceration, or an administrative error by Medicare or your health plan, may qualify for an SEP.

Disaster-Related Extensions and Caregiver Considerations

If you or your caregiver lives in or moves from a FEMA-declared disaster area, you may be eligible for additional time to adjust your coverage. These SEPs are not automatic. You must contact Medicare and explain your situation.

Timelines and What To Expect After You Make a Change

Once you make a change during the Medicare Advantage OEP or an SEP, your new plan typically starts on the first day of the following month. For example, if you enroll in a new plan in March, your coverage begins on April 1. You’ll receive a new membership card and plan materials once your enrollment is processed.

It’s important to keep using your current plan until the effective date of your new one to avoid coverage gaps. If you’re switching back to Original Medicare, consider adding Medigap (Medicare Supplement Insurance) to help cover out-of-pocket costs.

If You Don’t Qualify for a Special Enrollment Period

If none of the Special Enrollment Period (SEP) circumstances apply to you and you’re not eligible to make changes right now, you won’t be able to switch or update your Marketplace health plan until the next Open Enrollment Period. Your current coverage will stay in place automatically, so your healthcare access continues without interruption.

Get Ready for Future Enrollment With a Guided Medicare Review

Even if you’re not eligible for changes right now, reviewing your plan annually can help you prepare for future enrollment periods. Coverage details, drug formularies, and provider networks often shift from year to year, sometimes subtly, sometimes significantly.

By sitting down with a licensed Medicare specialist, you can compare current plans to identify potential savings or improved coverage, learn whether you qualify for any ongoing assistance programs, and get personalized guidance if your health needs or financial situation change midyear.

Your healthcare needs deserve the right coverage and the right timing. Reach out to Sackett & Associates to set up your personalized review and make sure your Medicare works as well for you as it can.

Share This Post

Taking The Pain Out Of Health Insurance

We make it simple to find the right insurance plans for your needs

In just a few quick steps.