Share This Post

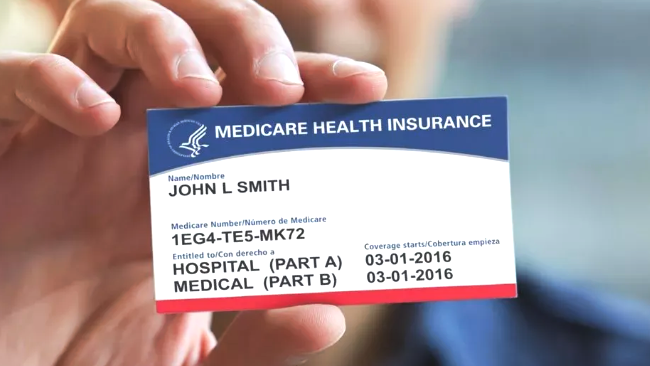

The 8-Month Rule for a Medicare Health Insurance

Health insurance can be complicated, particularly when you enter a period of transition. The main transition periods include leaving a parent or guardian's plan, being added to a spouse's plan and retiring. Medicare health insurance brokers can assist you as you prepare for and navigate the retirement transition.

What Is Medicare and Why Do You Need a Health Insurance Broker?

Medicare is health insurance that the federal government provides for three groups:

- People aged 65 and older

- People under age 65 but who have qualifying disabilities

- People who have been diagnosed with End-Stage Renal Disease (ESRD)

A Medicare health insurance broker specializes in helping people get the healthcare coverage they need from their Medicare insurance policies. The broker may work with employers, individuals or both.

Who Qualifies

If you fall into one of the three eligible groups, you should qualify. However, several other factors may influence your eligibility:

- Whether you're signing up for Part A or Part B

- Whether you're signing up during the General Enrollment Period or a Special Enrollment Period

- Whether you're joining a plan such as the Medicare Drug Plan (Part D) or the Medicare Advantage Plan

- Whether you want additional coverage

Medicare Part A

Part A is hospital insurance, providing coverage for:

- Inpatient care at hospitals

- Hospice care

- Home healthcare

- Admittance to skilled nursing facilities

Medicare Part B

Part B is medical insurance. It provides coverage for various types of outpatient care, including:

- Visits to your primary care physician

- Medical equipment

- Home healthcare

- Preventive services, such as annual checkups and vaccinations

Medicare Part D

Part D provides coverage for drugs, including:

- Prescription medications

- Vaccinations

You will not automatically qualify for this part of Medicare. Instead, you will need to join a Medicare Advantage Plan or a Medicare drug plan through a private insurance company.

Medicare Supplemental Insurance

You can also purchase Medicare supplemental insurance (also called Medigap) from private insurance companies. These policies provide additional insurance coverage to help people cover out-of-pocket medical expenses.

How To Apply

Some people, such as those already receiving Social Security benefits, will be enrolled in Parts A and B automatically.

If you aren't automatically enrolled, you can sign up for both Part A and Part B when you turn 65, during the Initial Enrollment Period. This period begins three months before your birthday month and extends three months after your birthday month.

Every year, there is a General Enrollment Period between January and March. There are also Special Enrollment Periods, covering unusual situations such as:

- Exceptional conditions prevented you from signing up during the Initial or General Enrollment Periods

- Being abroad during the Initial or General Enrollment Periods

If you are still working or are still covered by a spouse's insurance policy, you can choose to delay signing up.

When you're ready to apply, you must decide whether you want to sign up for only Part A or for both Parts A and B. You can apply for coverage online or download application forms to fill out and submit them via fax or mail.

Healthcare Insurance Brokers

If you need more information or assistance applying for Medicare or determining whether you qualify, you can contact a Medicare health insurance broker. A representative can explain:

- When the coverage begins

- What you qualify for

- What enrollment periods and special enrollment periods are

- Whether you should sign up for Part D

- Whether you should apply for Medicare supplemental insurance

What Is the 8-month Rule?

The 8-month rule refers to the maximum period of time a person has to enroll in Medicare after one of two scenarios:

- His or her employer coverage ends

- He or she stops working

The enrollment period begins after whichever scenario occurs first. You do not need to wait for both scenarios to occur before you sign up.

Being aware of this rule can help you plan ahead to avoid leaving any gaps in your health insurance coverage.

What You Need To Know

It's important to keep the 8-month rule in mind when you plan and apply for Medicare. If you don't, you run the risk of paying penalties. By following the 8-month rule, you will save money.

For example, if you don't sign up for Part A within the 8-month enrollment period, you will be required to pay penalty fees each month you do not have coverage. The amount of the fee may also increase the longer you take to sign up.

Make sure you talk to your employer, your benefits administrator or a health insurance representative when you're planning your Medicare coverage. They should all have experience helping people make the transition and will be able to advise you on enrolling or delaying coverage and answer your questions.

Talk To a Medicare Health Insurance Broker Now

Don't Wait! If you have any questions or need guidance, a Medicare health insurance broker can help you. For more information on or assistance with Medicare,

contact us today.

Share This Post

Taking The Pain Out Of Health Insurance

We make it simple to find the right insurance plans for your needs

In just a few quick steps.