Share This Post

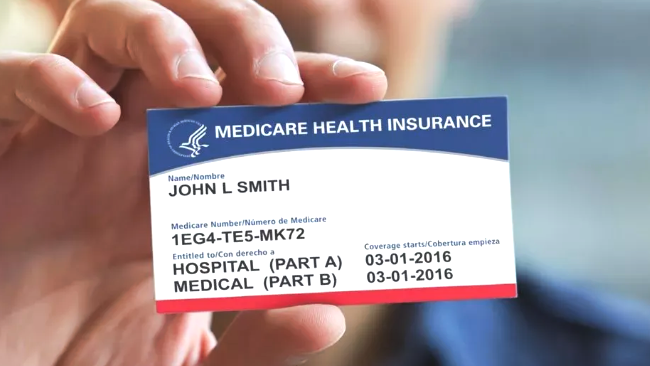

Sign Up for Medicare: How and When to Enroll in Medicare

There are many paths to enrolling in Medicare. While some people are automatically enrolled, others may need to take steps to get their enrollment finalized. For information on how and when to enroll in Medicare, read below.

How to Enroll in Medicare

You can enroll in Medicare over the telephone, but different situations can require specific phone numbers. For instance, if you previously were employed by a railroad, enrollment in Medicare should be completed by calling the Railroad Retirement Board. They can be reached at 1-877-772-5772. For TTY users, the number is 1-800-325-0778.

You may also enroll in Medicare by contacting Social Security via telephone at 1-800-772-1213 or, for TTY users, 1-800-325-0778. Their office hours are 7AM to 7 PM Monday through Friday.

Enrolling in Medicare online is another option for those who are computer-savvy. You can apply online through the Social Security website.

When to Enroll in Medicare

Enrollment periods vary depending on circumstances. If you are receiving Social Security or Railroad Retirement Board retirement benefits, you will be automatically enrolled in Medicare Part A and Part B. If you reside outside of the United States or D.C., you may be automatically enrolled in Medicare Part A, but you must manually enroll in Medicare Part B.

Situation A: You Receive Disability Benefits

For those who are younger than 65 but receive disability benefits through Social Security or the Railroad Retirement Board, enrollment in Original Medicare, Medicare Part A and Part B will be automatic after you have received disability benefits for 24 months. There is an exception for those who have end-stage renal disease (ESRD). For those who have ESRD and need regular kidney dialysis or had a kidney transplant, Medicare is an option. Individuals who have Lou Gehrig’s disease or amyotrophic lateral sclerosis (ALS) will be enrolled in Original Medicare automatically when disability benefits begin.

Situation B: You Don’t Want Medicare Part B

For those who have been enrolled in Medicare Part B automatically but don’t want to keep it, you can still drop it. If you were sent a card but your Medicare coverage has yet to begin, you can simply send the card back per the instructions that came with it. If you keep the card, however, that is considered acceptance of the plan and you will be responsible for paying Medicare Part B premiums. Those who signed up through Social Security will need to contact Social Security for directions on how to cancel Medicare Part B coverage.

For those with healthcare through their employment, delaying Medicare Part B is an option. Contact your health benefits administrator to get information on how things might change if you decide to drop your Medicare Part B enrollment.

Situation C: You Don’t Receive or Qualify for Retirement Benefits

Individuals who are nearing 65 but have not yet begun to receive retirement benefits can enroll in Medicare Part A and Part B. Even if you have decided to delay Railroad or Social Security retirement benefits, you can still enroll in Medicare and accept your retirement benefits later on.

If you will not receive retirement benefits at any point through Social Security or from past employment, your enrollment into Original Medicare will not be automatic. You may still sign up during your IEP for Medicare Part A, though it’s possible you will not get yours premium-free. Your premium will instead depend on factors such as the length of time you were employed and paid into Medicare. Your Medicare Part B premium will also need to be paid.

Situation D: You Didn’t Enroll During Your IEP When First Eligible

If for some reason you chose not to enroll in Medicare when you first became eligible, you may still enroll during what is called the General Enrollment Period. For Original Medicare, this lasts from January 1 to March 31 annually. Late enrollment penalties can apply for those who did not sign up during their IEP.

Situation E: You Lost Other Coverage and Need to Enroll

If you chose not to sign up for Medicare Part B initially because you had other medical insurance, you have an option to enroll during a Special Enrollment Period if your insurance is lost or you choose to make the switch to Medicare. This special period is different for every person as it starts when either your employment or health insurance ends, whichever comes first. After this occurs, you have eighth months to enroll and usually do not have to pay a penalty for late enrollment as long as you enroll within this period of time.

Medicare Part C and Medicare Part D

In addition to the main Medicare Parts A and B, you may also enroll in Part C and Part D. Medicare Part C or Medicare Advantage is a way of receiving Original Medicare benefits that is offered through private insurance. Medicare Part D is intended to help cover costs related to prescription drugs.

Medicare enrollment can be a complicated process but getting the coverage you need is vital. For help navigating Medicare enrollment and making sure you’ll get the care you need when you need it, contact Sackett and Associates Insurance Services today.

Share This Post

Taking The Pain Out Of Health Insurance

We make it simple to find the right insurance plans for your needs

In just a few quick steps.