Share This Post

Hospital Treatment Without Insurance: Costs, Coverage, and Alternatives

If you have a medical emergency, healthcare providers can’t turn you away without essential services if you don’t have medical insurance. The Emergency Medical Treatment and Labor Act (EMTALA) requires healthcare facilities to provide essential lifesaving services to anyone with a medical condition, no questions asked.

However, after fulfilling this legal obligation, a healthcare provider will require payment. If you don’t have healthcare coverage, the hospital will bill you for every service provided. They will need you to foot the hospital bill, covering everything from doctor’s fees to medical costs. With a healthcare plan to cover some of these services, the bill from even the shortest emergency stays can be astronomical.

How are Medical Bills Paid?

You’re on the hook for the total cost of healthcare services when you receive treatment without health insurance. Typically, the hospital provides an itemized bill detailing the services, procedures, medication, and supplies provided during your hospital stay.

Without coverage, your charges will likely be higher because the chargemaster rates do not apply to you. These are preferential prices that insurance companies or government programs negotiate with healthcare providers for covered services and medication.

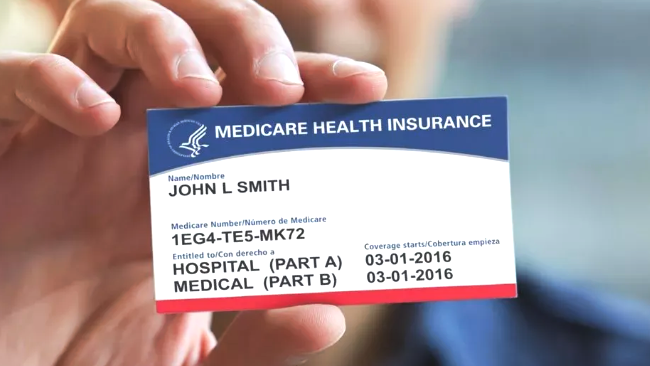

When you have coverage, your healthcare plan will cover a portion of your medical bills. The exact amount covered depends on your specific plan, as different types of health plans, such as Medicare, Medicaid, and individual health coverage, provide varying levels of coverage.

Typically, health insurance covers the lion’s share of your medical bills, leaving you to foot only a tiny portion as deductible, coinsurance, or copayment.

A deductible is the amount of money you pay out-of-pocket before insurance coverage kicks in. After meeting the deductible, you may have to pay a small portion of treatment costs as coinsurance.

For instance, your health plan may cover 80% of the cost of a health procedure, leaving you only to pay 20%. Some services, such as doctor visits or prescription medications, may carry a copayment and may require you to pay a small portion, usually less than 30%, of the total costs.

Negotiate a Discount or a Payment Plan

It may seem inconceivable, but hospitals can be pretty accommodating to uninsured patients. You can tactfully negotiate discounted rates for services or a payment plan to help you clear the bill. Ideally, you should initiate negotiation before treatment if going in for an elective service.

While you may engage the billing department, you will have better results negotiating with the hospital’s ombudsman. Unlike the billing department, which is primarily concerned with revenue collection, an ombudsman is charged with resolving patient issues.

Start by explaining your circumstances and provide supporting documentation, such as proof of income to prove financial hardship. You can inquire about the hospital’s financial assistance programs, discounts, and payment plans. Some hospitals may offer sliding scale rates for low-income patients. Non-profit hospitals are legally required to provide charitable care to patients with financial challenges.

Consider Using Urgent Care

Urgent care centers are an excellent option if you need prompt medical attention but don’t have coverage or are short on cash. The cost of an urgent care visit may be less than half a typical trip to the ER.

Unlike a doctor’s office, urgent care centers are staffed by nursing practitioners. They can help you address non-emergency medical issues such as minor fractures, burns, and infections that require prompt attention. Depending on your circumstances, the staff may advise you to seek medical care or visit the ER.

Urgent care centers provide affordable healthcare because they have lower operating costs and can pass the cost savings to patients. You’ll only incur a consultation fee, any lab fee, and prescription drugs. Conversely, the cost of an ER visit is more expensive because it covers the doctor’s fee, hospital fee, hospital stay, prescription, and lab fees.

While cheaper, you’ll need to pay upfront for services when visiting urgent care if you don’t have health coverage.

Safeguarding Your Health without Incurring Medical Bills

A study by the Kaiser Family Foundation found that 1 in 10 Americans are burdened by huge medical bills. More than 11 million people owe $2,000, while 3 million patients have more than $10,000 in unpaid hospital bills.

The Centers for Disease Control and Prevention (CDC) estimates 27.6 million Americans are uninsured. The figure correlates closely to the 23 million people that the KFF survey found grappling with massive medical bills. Therefore, you may struggle with massive medical bills if you lack health insurance.

A medical health plan such as Medicare or Medicaid covers the lion’s share of your hospital bill, leaving you only to foot a small portion. Coverage makes healthcare more accessible while allowing you to safeguard your health without going into debt.

Talk to Skilled Health Insurance Broker

With so many options available, getting the best Medicare or individual plan can prove challenging. Working with the skilled Medicare health insurance experts at Sackett & Associates can help you make an informed choice. Contact us today for more information or assistance with Medicare or individual plans.

Share This Post

Taking The Pain Out Of Health Insurance

We make it simple to find the right insurance plans for your needs

In just a few quick steps.