Share This Post

What To Remember When Choosing Long Term Care Insurance

Growing older is inevitable, and the time may come when you need assistance with basic needs and help with tasks such as getting dressed or going to the doctor. If you don't want to be a burden on your children, you need to think about how you will pay for long term care, should you need it.

The Department of Health and Human Services recently came out with a study that found that an estimated 70 percent of people who are 65 or older may need long term care at some point in their lives. The cost of having a home health care worker come to your house can run into the thousands. Staying at a nursing home can be twice that amount. That's why long term care insurance is so important. Still, not everyone needs this type of insurance.

When You Might Need Long Term Care Insurance

If you have a nest egg or property that you want to preserve to leave to your heirs, long term care insurance helps offset the costs of that care. That way, you won't be forced to sell your home or liquidate other assets to pay for your stay in a nursing home.

When You Don't Need Long Term Care Insurance

If you have less than 100,000 saved or in assets, you likely don't need long term care insurance. Medicaid will pay for your care.

Pros and Cons of Long Term Care Insurance

There are some positive aspects to having long term care insurance. There are also some negatives to this type of coverage.

1. Pros of Long Term Care insurance

This type of insurance ensures you get the care you need when you need it and provides you with peace of mind. Having this type of insurance takes the stress off of your children and other family members. You don't have to worry about being a burden on them. It also protects you from losing your savings when paying for long term care.

2. Cons of Long Term Care Insurance

Long term care insurance is expensive, and the premiums will inevitably go up. Once you commit to an insurance company, you are locked in because you won't be able to get your premiums out. The insurance industry tends to be volatile, meaning an insurance company that is going strong today may wind up bankrupt in five or ten years.

When You Should Buy Long Term care Insurance

You must purchase long term care insurance before you need it. The longer you wait, the higher the premiums will be. Also, if you are in poor health, you might not qualify for this insurance. For most people, the best age to buy it is when they are in their early to mid-fifties.

A Health Insurance Broker Can Help You

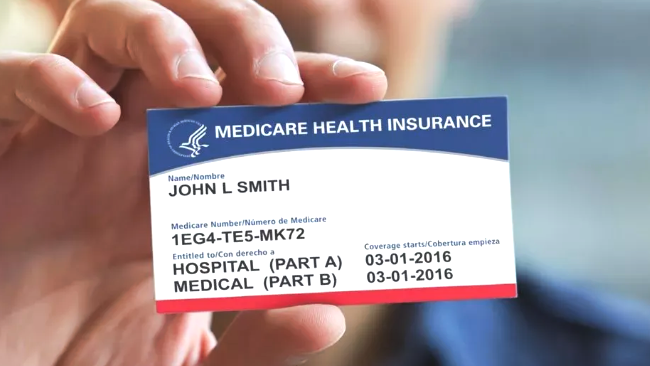

A health insurance broker can help you find the right long term care insurance and will be with you in the process from start to finish. Unlike an insurance representative that only represents one insurance company, a health insurance broker can show you plans from several different companies. Sackett Insurance Services is a health insurance broker specializing in Medicare.

Consider a Hybrid Policy

These days it is much harder to find a simple long term care insurance policy. Insurance companies are offering hybrid policies instead. These are whole-life insurance policies that will return your premiums to your heirs even if you never need long term care.

How Much Long Term Care Insurance Costs

If you purchase the insurance when you are in your mid-sixties and you are in good health, your policy will likely cost you between $1,400 to $2,100 annually. A good rule of thumb is to pay no more than 5 percent of your income on long term care insurance.

What To Keep in Mind When Purchasing Long Term Care Insurance

Let your children or other loved ones know about the policy. They will likely be the ones filing a claim to get the care started in the future. Also, expect a wait of three months before your benefits kick in and start paying for your care.

Most policies will only pay out benefits for a maximum of three years. This should be sufficient as most people, on average, stay at a nursing home or other facility for less than a year.

Talk to a Health Insurance Broken When You're Ready for Long Term Care Insurance

Talk to a health insurance broker and look at several different plans before you commit. Make sure you understand what each policy offers and what you'll have to pay out of pocket. Also, ask what the rate hikes will be each year. Ask about discounts as well. You'll likely pay less if you are in good health and if you are married and purchasing policies with your spouse. For more information on finding the right long term care insurance plan for you, call us at (707) 823-3689 or

contact us online here.

Share This Post

Taking The Pain Out Of Health Insurance

We make it simple to find the right insurance plans for your needs

In just a few quick steps.